Have you ever heard of the Theo T?

Not many people have, yet it holds an exciting role in U.S. history. With all the geopolitical volatility raging in the Middle East right now, you may have heard about the 1973 Arab oil embargo.

Back then, OPEC members imposed an embargo against the United States and a few other countries for giving aid to Israel during the Arab-Israeli War.

Less than two years later, the U.S. made the hard decision to ban all exports of U.S. crude oil abroad. In theory, this would help protect American consumers from wild price swings on the open market.

Truth is, it didn’t really matter anyway because there wasn’t much oil available for export.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

By 1975, U.S. oil production had already started a long, steady decline that persisted for 37 years!

During that period, our domestic production was cut in half.

But all of my readers know that this story has a happy ending — the advent of the tight oil boom changed things forever.

Within seven years, the U.S. oil industry not only reversed that decades-long decline, but pushed production back above 9 million barrels per day. This newfound oil wealth prompted Congress to lift the long-standing oil export ban that had been in place.

So one Thursday afternoon on December 31, 2015, the Theo T became the first oil tanker to be loaded with U.S. crude oil and headed out to sea.

Since then, the world has acquired a serious taste for U.S. oil.

Bulls vs. Bears: One Driller to Rule Them All

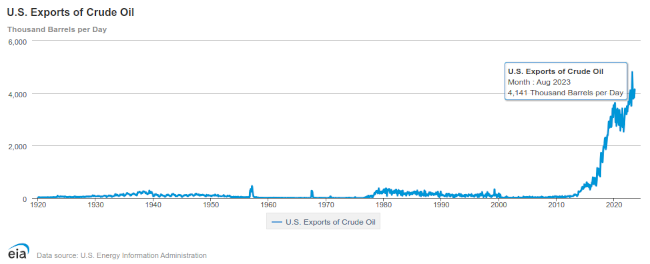

Look, it’s easy to see the kind of growth that U.S. oil exports have enjoyed since that 37-year ban was lifted. As you can see below, our shipments of crude oil exploded in the years that followed:

Last August, U.S. oil exports averaged 4.1 million barrels per day. But this shouldn’t be too surprising considering the fact that our domestic production has once again climbed into record territory and is now sitting at 13.2 million barrels per day.

Right now there’s a war being fought between the bulls and bears in the oil market.

One side points to China recently cutting fuel prices and announcing stricter rules on the import of oil and other commodities.

Remember, the IEA has told us that China is going to be responsible for more than 70% of global demand growth in 2023.

If China’s economy falters and heads into a deep recession, it will drag down global oil demand along with it… but let’s not forget that the media have been calling this collapse in the Chinese economy all year, or that global inventories are perilously low.

And although that’s enough to shake the tree and put downward pressure on crude prices, the market is also harping on lower U.S. demand — but never mind the fact that this is seasonally when oil prices are supposed to be weak.

Despite all the doom and gloom, the world is still lining up for more and more U.S. oil.

We’ve come a long way since the Theo T left the Port of Corpus Christi that Thursday afternoon.

A LONG way.

Bloomberg recently reported that there are 48 oil tankers charging toward the U.S. Gulf Coast to get their fill of Texas tea — the most we’ve seen in six years.

Have you spotted the winner here yet?

If you’re one of my veteran readers, I’m betting you have. In fact, they’ve been actively profiting from this all year, simply from the fact that more than 97% of all U.S. is exported from just one area: The U.S. Gulf Coast.

But it’s not enough to blindly throw a dart against the wall and hope you hit a winner. That may have worked during the early years of the shale boom, but times have changed.

That’s why I’ve put this free investment report together for my readers that not only identifies three must-own oil stocks for 2024, but also reveals another opportunity that has opened up due to the world’s renewed thirst for U.S. oil exports.

You need to check this one out for yourself.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.